Comprehensive Guide to Amortization Calculators: Types, How to Use Them, and Their Benefits

This comprehensive guide explores the various types of amortization calculators, detailing how to use them effectively and outlining their significant advantages. It covers practical steps for loan calculation, benefits for borrowers, and strategies to accelerate loan repayment, making it an essential resource for smart financial management and informed borrowing decisions.

A Complete Overview of Amortization Calculators: Types, Practical Usage, and Key Advantages

Amortization is a financial process that involves gradually paying off debt or reducing the value of an asset over time through a series of scheduled payments. This process ensures that each payment covers both interest charges and a portion of the principal amount, enabling borrowers to monitor their repayment progress with clarity. An amortization calculator serves as an essential financial tool that helps individuals and businesses determine the precise payment required to fully repay a loan within a specified timeframe. By providing a detailed breakdown of how each installment affects the remaining loan balance, these calculators facilitate better financial planning and informed decision-making.

What is an amortization calculator? Essentially, an amortization calculator computes how each periodic payment is divided between interest and principal repayment. It offers users a transparent view of the repayment structure, illustrating how the loan balance decreases over time or the interest accruals grow if payments are delayed or less frequent. This insight is invaluable for borrowers to understand the long-term costs of their loans, optimize repayment strategies, and plan future financial commitments more effectively.

Employing an amortization calculator empowers you to visualize how your regular payments influence your loan’s principal and interest components over the repayment period. It provides crucial insights into the total costs associated with a loan, allowing borrowers to plan their finances more proactively. These tools are highly versatile, applicable not just to traditional mortgage loans but also to auto loans, personal loans, student loans, and any financial arrangements that involve amortized payments.

How is amortization calculated?

Using an amortization calculator is straightforward once you have all necessary loan details. Follow these steps for accurate computations:

Enter the Loan Amount: Input the total amount of money borrowed or to be borrowed for the loan. This figure forms the basis for the entire repayment schedule.

Specify the Loan Term: Determine the duration over which the loan will be repaid, such as 15, 20, 25, or 30 years. The length of the term directly impacts the monthly payment and total interest paid.

Provide the Interest Rate: Input the annual interest rate applicable to the loan. This rate influences how quickly the principal is paid down and the overall cost of borrowing.

Set the Start Date: Indicate the month and year when repayments will commence. This helps in generating precise amortization schedules aligned with your payment plan.

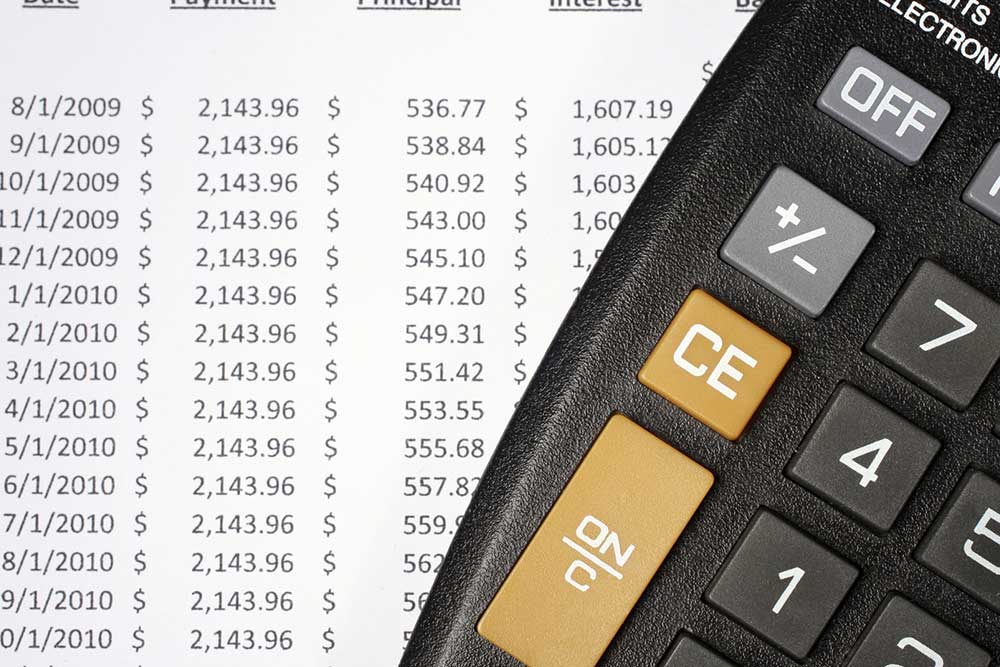

Once these inputs are entered, the calculator generates a detailed schedule showing the monthly payments, how much goes toward principal and interest, and the remaining balance after each payment. For more granular insights, such as total interest paid over the life of the loan or early payoff scenarios, refer to the complete amortization schedule output.

Various Types of Amortization Calculators

Simple Amortization Calculator: This basic tool calculates the total principal amount to be paid over the entire duration of the loan, helping understand overall payoff requirements.

Mortgage Amortization Calculator: Designed specifically for home loans, this calculator provides a detailed breakdown of each monthly payment, showing how payments are split between interest and principal. It often includes features for showing potential savings from making extra or early payments.

Amortization Schedule Calculator: Offers a comprehensive table listing each scheduled payment, including interest paid, principal reduction, and remaining balance at any given point. It’s ideal for detailed financial analysis and strategic planning.

Advantages of Using an Amortization Calculator

Efficiency and Precision: Automates complex calculations, providing quick, accurate results without manual computations. This saves time and reduces errors.

Better Financial Understanding: Enhances knowledge about how loans work and how extra payments can reduce total interest paid and shorten the loan term.

Informed Decision-Making: Facilitates comparison between different loan options by changing parameters such as interest rates and terms, aiding in selecting the most suitable financing plan.

Strategies to Pay Off Loans Faster

Make Additional Payments: Contributing extra amounts or opting for biweekly payments instead of monthly installments can significantly reduce the principal faster and decrease total interest costs.

Refinance or Recast Loans: Refinancing involves obtaining a new loan with better terms, while recasting adjusts the existing loan’s schedule based on a lump sum payment, both strategies to accelerate payoff and improve financial flexibility.

It’s important to note that while amortization calculators are invaluable tools, some lenders may impose prepayment penalties for settling loans early. Always review your loan agreement thoroughly, and choose reputable lenders with transparent policies, to ensure smooth and cost-effective repayment processes.