Comprehensive Guide to Mortgage Prequalification: Essential Insights for Homebuyers

Understanding mortgage prequalification is vital for prospective homebuyers. This comprehensive guide explains its importance, the necessary information to prepare, and how it can streamline your home-buying process. Prequalification helps you gauge borrowing capacity, compare loan options, and demonstrate seriousness to sellers. With detailed insights into documentation and benefits, this article prepares you for a successful mortgage application journey, enhancing your confidence and financial readiness in the competitive housing market.

Comprehensive Guide to Mortgage Prequalification: Essential Insights for Homebuyers

Embarking on the journey to purchase a new home is an exciting milestone, but it can also be fraught with complexities and uncertainties. One of the most crucial early steps in this process is understanding mortgage prequalification. This step not only helps you gauge how much you can borrow but also streamlines your home-buying experience by providing clarity about your financial standing before you begin serious negotiations. While many homebuyers are familiar with the concept of prequalification, understanding its full scope, benefits, and the detailed process can significantly enhance your chances of securing favorable mortgage terms.

What exactly is mortgage prequalification and why does it matter?

Mortgage prequalification is an initial assessment conducted by lenders to estimate how much you might qualify to borrow for a home loan, based on the financial information you provide. Usually, this process involves a soft credit inquiry, which doesn’t impact your credit score, and serves as a preliminary step before formal approval. Prequalification empowers buyers by showcasing their borrowing potential, facilitating better comparisons among different lenders, and planning their home purchase more effectively. It is especially valuable if you have a strong credit profile, as it opens doors to advantageous interest rates and loan terms.

Why is getting prequalified essential?

First and foremost, prequalification gives you a realistic picture of your purchasing power. It informs you about the price range of homes you should consider, saving you time by narrowing down options to properties within your financial capabilities. Furthermore, a prequalification letter from a credible lender demonstrates to sellers that you are serious and financially prepared, which can give you an edge in competitive markets. Additionally, prequalification enables you to explore various mortgage options, compare different interest rates and terms, and identify the most cost-effective financing solutions tailored to your needs.

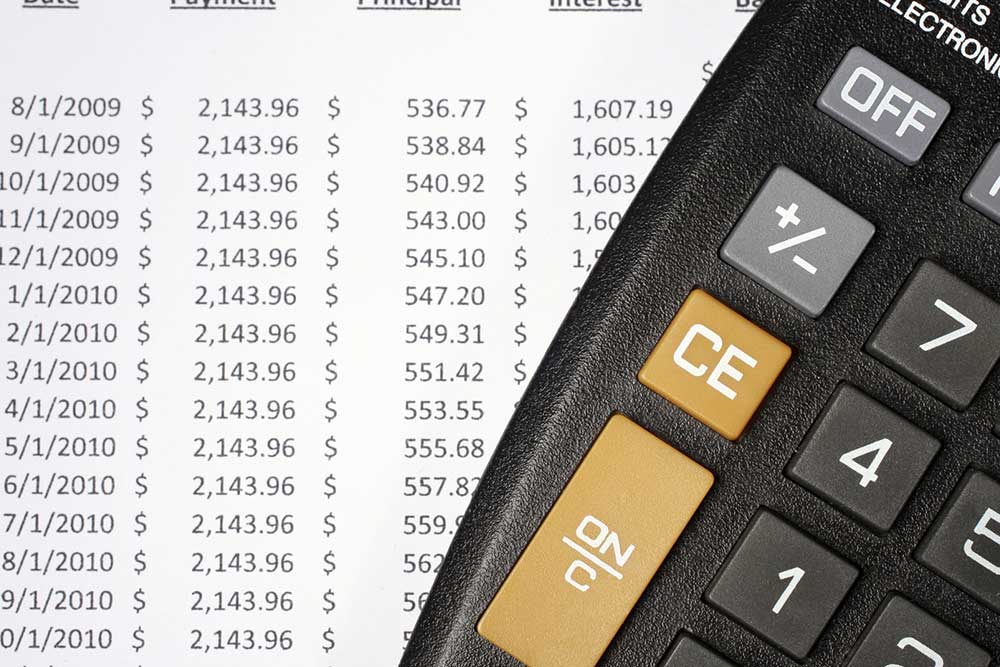

Prequalification also helps you understand the interest rates you might expect, the size of your down payment, and potential monthly payments, providing a comprehensive overview that facilitates better financial planning. It’s a strategic step that not only boosts your confidence but also empowers you to approach the home-buying process with clarity and a well-defined budget.

Prequalification is an essential step for prospective homebuyers, offering a snapshot of their financial health and borrowing capacity. It enables individuals to identify the most competitive mortgage options and secure favorable interest rates by providing lenders with key financial information swiftly and efficiently.

What information do you need to prepare for mortgage prequalification?

Most lenders provide convenient online prequalification forms that you can fill out in the comfort of your home. These forms require specific details to give an initial estimate of your eligibility for a mortgage loan.

Typically, the information needed includes:

Loan purpose: Clearly specify whether you are seeking to refinance an existing mortgage or purchasing a new property. Clarifying your loan purpose helps lenders tailor their offers and requirements accordingly.

Bank details: The name of your banking institution and its branch location. This information helps lenders verify your bank account status and transaction history.

Loan type: Your preferred mortgage type, such as a 15-year fixed-rate mortgage, a 30-year fixed, or an adjustable-rate mortgage (ARM). Remember, these choices can be revised later during the formal application process, but initial qualification helps set realistic expectations.

In addition to these basics, the prequalification process generally requires further personal and financial information, including:

Personal details: Full name, date of birth, contact information, Social Security Number, and mailing address. In cases where there is a co-applicant, their details may also be necessary. These details are critical for the lender’s initial assessment and for any subsequent credit checks.

Employment and income verification: Tax return documents, pay stubs, employment verification letters, and possibly recent bank statements. The specifics depend on whether you are a W-2 employee, self-employed, a freelancer, or have other sources of income, such as rental properties.

Assets: Documentation of your financial assets such as bank savings, retirement accounts, brokerage holdings, and any other investments. Demonstrating your liquidity reassures lenders about your ability to cover down payments and closing costs.

Liabilities: Details of existing debts, such as student loans, car loans, credit card balances, and other monthly obligations. Lenders use this information to calculate your debt-to-income ratio, a crucial factor in prequalification.

Other supporting documents that might be requested during the prequalification process include rent payment history, divorce decrees related to financial settlements, records of bankruptcy or foreclosure, or gift letters if your down payment includes assistance from family or friends.

Performing online prequalification is an easy, quick, and effective way to understand your borrowing capacity. By providing accurate and comprehensive data, you enable lenders to provide you with an initial approval, helping you plan your home purchase with confidence and clarity. This process is entirely confidential and does not impact your credit score, making it an ideal first step towards your homeownership goals.