Comprehensive Guide to Senior Life Insurance: Securing Your Family’s Future and Financial Peace of Mind

This comprehensive guide discusses the importance of senior life insurance in securing your family's financial future. It highlights benefits such as financial assistance, coverage for medical and funeral expenses, debt management, and estate planning strategies. By choosing reputable insurers and suitable policies, seniors can ensure peace of mind and financial security during retirement and beyond. Learn how senior life insurance can safeguard your legacy and support your loved ones in life's later stages, offering peace of mind for a brighter tomorrow.

Comprehensive Guide to Senior Life Insurance: Securing Your Family’s Future and Financial Peace of Mind

As life expectancy continues to rise worldwide, planning for the future becomes increasingly important, especially when it comes to safeguarding your loved ones’ financial well-being. Senior life insurance has emerged as an essential component of comprehensive financial planning for elderly individuals. According to recent statistics from the Social Security Administration, women tend to live an average of 87 years, while men average around 84 years. These numbers highlight the importance of choosing suitable coverage that can last a lifetime, providing security and peace of mind for seniors and their families alike. A well-structured senior life insurance policy provides more than just a death benefit; it acts as a safety net that ensures your loved ones are financially protected in your absence, covering everything from medical bills to estate transfer expenses.

Understanding the benefits and the different types of senior life insurance policies available is crucial for making informed decisions that align with your financial goals and family needs. This comprehensive guide explores the vital advantages of senior life insurance, including financial assistance, coverage for medical and funeral expenses, debt management, and estate planning strategies. Furthermore, we will analyze how to select reputable insurers like New York Life, American National, Banner Life, Mutual of Omaha, Transamerica, Fidelity Life, and Northwestern Mutual to secure the best possible coverage tailored to your circumstances.

Financial Assistance in Retirement

Retirement signifies a new phase of life where many previous working routines change into a phase of leisure and relaxation. However, ongoing expenses such as healthcare, housing, and everyday living costs continue to accumulate. While pensions, savings, and social security benefits provide a foundation, they alone may not cover all financial needs, especially unforeseen emergencies. Incorporating a senior life insurance policy into your financial plan can serve as a crucial source of additional support, providing funds when most needed and easing the financial burden on your family. This type of insurance not only offers peace of mind but also acts as a strategic financial resource ready to assist during unexpected situations.

Medical & Funeral Expenses Coverage

As healthcare costs escalate yearly, they represent a significant financial challenge for families supporting aging loved ones. Medical treatment, hospital stays, prescription medications, and long-term care can quickly deplete savings, pushing families into debt. A robust senior life insurance plan can help mitigate these costs by providing lump-sum payments or ongoing support to cover significant medical expenses. Funeral costs are another substantial financial concern, with the average funeral expenses now around $11,000, excluding additional services such as memorials or floral arrangements. As these costs are expected to rise, having life insurance coverage ensures your family won’t be overwhelmed financially during their period of grief. It relieves the emotional and financial stress by taking care of these arrangements in advance, allowing your loved ones to focus on mourning and memories, rather than monetary challenges.

Debt Management and Financial Obligations

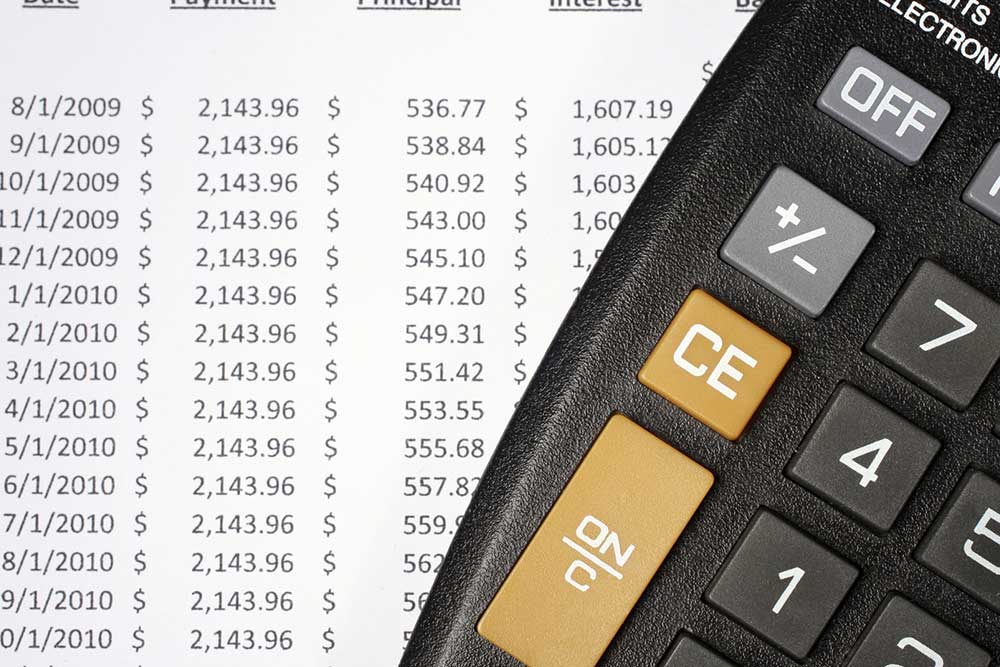

Many seniors carry debts from various sources, including mortgages, personal loans, credit cards, or remaining medical bills. These debts do not disappear with death and can place an unexpected financial burden on families, forcing them to liquidate assets or incur further debt to settle outstanding obligations. Purchasing a senior life insurance policy helps prevent that scenario by ensuring that debts are paid off promptly, protecting your heirs from unnecessary financial stress. These policies can be specifically tailored to cover outstanding liabilities, offering a form of financial completeness and peace of mind that no unforeseen obligations will fall on your loved ones after your passing.

Estate Planning and Tax Considerations

For seniors with significant estates or complex asset portfolios, life insurance can be a vital tool in estate planning. Properly structured policies can facilitate the transfer of wealth, help minimize estate taxes, and ensure that heirs receive their inheritance with fewer deductions. Life insurance proceeds can serve as liquidity to pay estate taxes or other expenses, preventing heirs from being forced to sell valuable assets or property to fund these costs. Strategic estate planning using life insurance can preserve family wealth over generations while also providing tax advantages under current laws. Consulting with a financial advisor or estate planner can help optimize these benefits and align your coverage with your overall estate transfer goals.

Considering top insurance providers such as New York Life, American National, Banner Life, Mutual of Omaha, Transamerica, Fidelity Life, and Northwestern Mutual can open up options for customizable policies that suit your specific needs. Each company offers unique features, options, and financial strength, making it essential to compare plans thoroughly before choosing the most suitable coverage for your circumstances.

In conclusion, senior life insurance is a vital investment in your retirement years. It protects your family from financial hardship, covers critical expenses, manages debts, and supports estate transfer plans. By selecting a reputable insurer and a policy tailored to your needs, you can enjoy peace of mind knowing that your loved ones will be cared for, no matter what the future holds. Comprehensive planning today leads to a more secure and stress-free tomorrow for you and your family.