Comprehensive Guide to Reordering Personal Checks Safely and Efficiently

This comprehensive guide delves into the various methods and tips for reordering personal checks efficiently and securely. It covers online banking, third-party vendors, in-branch orders, and cashier checks, emphasizing security and convenience. Learn how to select the right option for your needs, customize checks, and maintain your financial safety. Perfect for individuals who rely on checks for their personal and business transactions, this guide ensures smooth reordering processes to keep your banking routines uninterrupted.

Comprehensive Guide to Reordering Personal Checks Safely and Efficiently

In today’s increasingly digital world, many people have shifted to electronic payments and online banking. However, despite the growth of digital transactions, physical checks continue to serve an important role in personal and business financial dealings. This guide provides an in-depth look at everything you need to know about reordering personal checks, ensuring your banking needs are met with convenience and security.

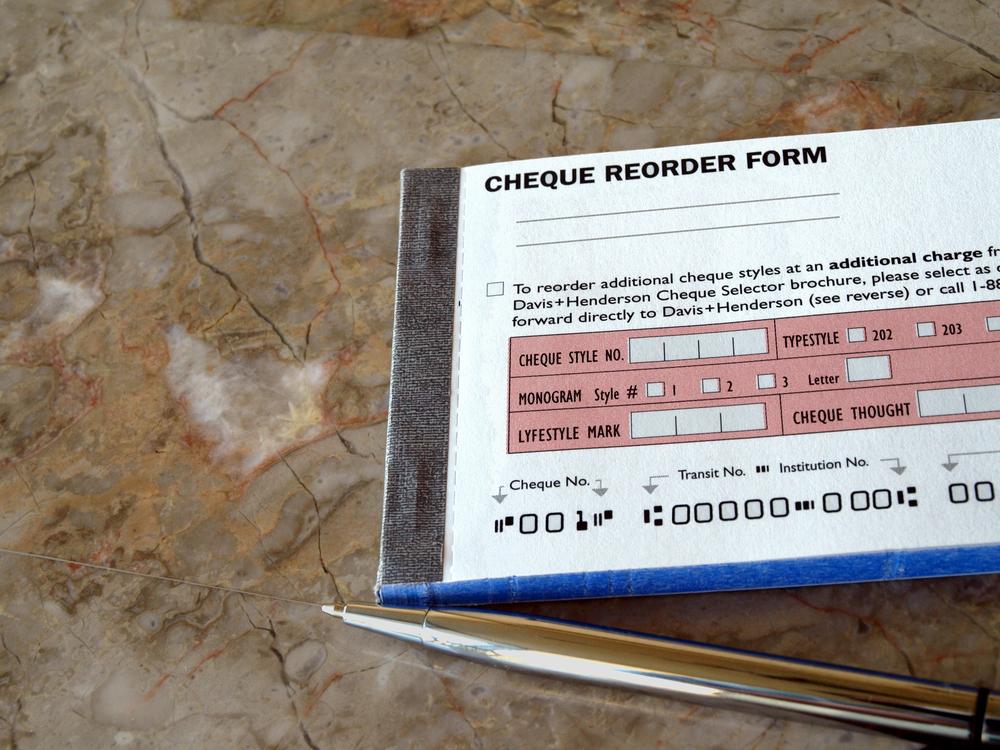

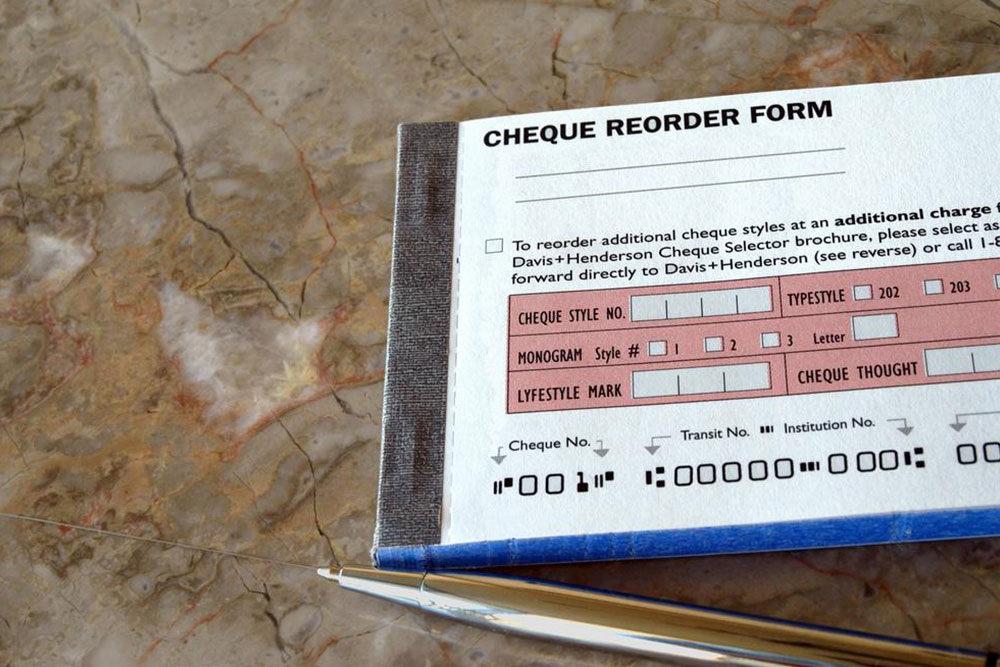

Checks are more than just a tool for payments; they also contain vital personal and financial information including your name, address, bank account number, and sometimes even your routing number. This information must be kept secure, which is why choosing trustworthy sources when reordering checks is crucial. Additionally, checkbooks are typically issued in limited quantities per booklet, so it’s essential to monitor your check supply and reorder promptly to avoid any delays in financial transactions.

Reordering checks can seem complicated, but with the right knowledge, it becomes a simple process. Be aware that prices for checks can vary significantly depending on your bank or third-party vendors. You may also have options for customizing your checks with logos, designs, or special security features. Whether you prefer to order through your bank, online marketplace, or directly in person, knowing your options helps you make the best decision for your financial security and convenience.

When it comes to reordering checks, numerous convenient options are available. Digital technology has simplified the process significantly, providing multiple avenues to get new checkbooks quickly and securely. The most popular method is through online banking, which offers the convenience of ordering from the comfort of your home or office. Moreover, some people prefer third-party vendors who might offer checks at lower costs, but selecting reputable vendors is essential to protect your banking information.

In addition to online ordering, you can also visit your bank branch or contact their customer service hotline. Visiting in person allows you to discuss your specific needs with banking staff, and you can often receive your checks immediately or within a few days. This method is particularly beneficial if you require personalized checks or need assistance with security features. Some banks also offer cashier checks, which are immediate-use checks sold at branches. These are especially useful for urgent transactions or when you need guaranteed funds quickly.

Below are detailed methods for reordering checks:

Online Banking Reorders: Log into your bank’s secure website using your login credentials. Navigate to the section for checking accounts or check reorder services. Confirm your personal and account details, select your preferred check design, and submit your order. Expect delivery within the specified timeframe, typically ranging from a few business days to a week. Always verify that the delivery address and contact information are current to avoid delays.

Third-Party Check Vendors: Several reputable third-party companies specialize in check printing and supplies. When choosing a third-party vendor, select one with a strong reputation for security and quality. Enter your bank details accurately and confirm your identity where necessary. These vendors often provide competitive prices, and some offer additional features such as customized checks with personal designs or enhanced security features. Once you receive your checks, always verify their authenticity and ensure that they contain correct information. Confirm with your bank if checks from these vendors are acceptable for your banking transactions.

Bank Branch and Phone Orders: Visiting your bank branch is a straightforward way to reorder checks. Bring your identification and request new checkbooks from a banking representative. The staff can assist with any customization options and update your account details if needed. You can often walk out with checks immediately or schedule a pickup date. For those preferring phone orders, call the bank’s customer service line, provide your account information, and follow the representative’s instructions to complete your check order.

Cashier Checks for Immediate Use: If you need checks instantly, cashier checks are an excellent option. They are purchased directly at your bank branch, withdraw funds immediately from your account, and are guaranteed funds. These are ideal for large payments, deposits, or situations requiring immediate financial guarantees. Keep in mind that cashier checks usually involve a broader fee than personal checks but offer unmatched security and immediacy.

Throughout the reordering process, prioritize security. Always use secure connections when ordering online and verify the authenticity of third-party vendors. When you receive your checks, inspect them carefully for any signs of tampering or errors. If you notice discrepancies or suspect fraud, contact your bank immediately to report the issue and take appropriate actions.

Regularly review your check usage and keep track of your checkbook balance. This helps prevent overdraft situations and ensures you have sufficient funds for upcoming payments. Many banks provide alerts for check activity, which can further improve your account security and management.

In conclusion, reordering personal checks involves understanding your options, choosing secure sources, and managing your checkbook efficiently. Whether you prefer digital methods, in-person visits, or quick cashier checks, maintaining a proactive approach ensures your financial transactions remain smooth and secure. Always stay informed about your bank policies and check yourself regularly for fraudulent activity or errors to keep your finances secure and well-organized.