Comprehensive Guide to Reordering Checks: 4 Proven Methods for Smooth Transactions

This comprehensive guide explores four reliable methods for reordering checks, including online platforms, phone banking, in-person visits, and verified third-party vendors. Learn how to quickly and securely order checkbooks to ensure continuous access to this essential banking service, with detailed instructions and tips for each method to help you manage your check supplies efficiently and effortlessly.

Comprehensive Guide to Reordering Checks: 4 Proven Methods for Smooth Transactions

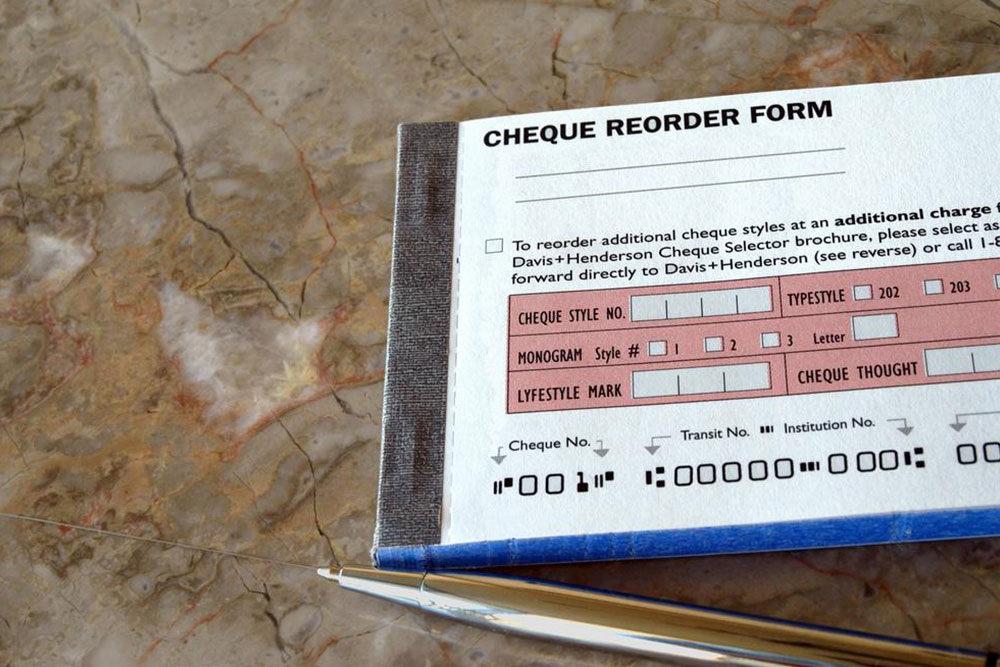

Despite the rapid shift toward digital banking solutions, physical checks remain a vital part of many people's financial routines, especially for transactions that require a formal or secure payment method. Whether for business purposes, personal use, or legacy reasons, knowing how to efficiently reorder checks is essential. When opening a new bank account, most banks include a starter checkbook, but these supplies are often limited in number. For those who rely heavily on checks, it's crucial to understand the most effective ways to reorder additional checkbooks seamlessly. This comprehensive guide explores four reliable methods that ensure you always have check supplies on hand, avoiding any interruptions in your financial activities.

Ensuring continuous access to checks not only facilitates smooth transactions but also enhances security and convenience. From online reordering to in-person visits and trusted third-party vendors, each method has its advantages and considerations. This article provides detailed instructions and tips for each approach, helping you choose the most suitable option based on your preferences and circumstances.

Reorder Checks Online via Your Bank’s Digital Platform

One of the most convenient and widely used methods to reorder checks is through your bank’s secure online banking platform. When you open a new bank account, most financial institutions assign you login credentials, allowing you to access a range of banking services digitally. If you haven't received your login details upon account setup, you can typically request them online or visit your local branch to obtain the credentials in person.

Once logged into your online banking account, navigate to the section dedicated to check services or check reordering. You'll usually need to input details such as your account number, account type, and routing number. Many banks have a dedicated check reorder option that guides you step-by-step, making it straightforward to request additional checkbooks. Some banks also offer the option to customize check designs or order them in bulk.

Using the online platform not only speeds up the process but also allows you to track your order status in real-time. It's advisable to place your reorder at least a few weeks before your current checks run out to ensure timely delivery and avoid any disruption to your transactions.

Reissue Checks via Telephone Banking

If you prefer speaking directly to a representative or if online options are unavailable, telephone banking offers an effective alternative for reordering checks. Call your bank's customer service helpline during working hours. Be prepared with your routing number, account number, and personal identification details to verify your identity.

Customer service representatives are trained to assist with check reorders and can process your request efficiently. They will confirm your details, verify your account status, and initiate the reordering process. Delivery times for new checks through this method typically range from 7 to 10 business days, depending on your bank's policies and your location.

It’s beneficial to keep your bank account information nearby during the call to expedite the process. Additionally, asking about expedited shipping options or bulk ordering discounts can save you time and money in the long run.

Visit Your Bank Branch in Person

For those who prefer a face-to-face interaction or have specific queries, visiting your local bank branch is a reliable and straightforward way to reorder checks. Before heading to the bank, make sure to carry your identity proof and account details, such as your checkbook or recent bank statements, to facilitate the process.

At the branch, a banking representative will assist you with your check reorder request. You can discuss design preferences, order quantities, and delivery options directly with the staff. This method allows for immediate clarification of any concerns and provides a personal touch that might be missing in digital or phone transactions.

Once your request is processed, your new checks will typically be delivered within 7 to 10 business days. This method is especially suitable if you require additional services, such as setting up new accounts or resolving banking issues during your visit.

Order Through Verified Check Printing Vendors

The rising popularity of online check printing vendors offers another dependable avenue for reordering checks. Reputable companies, such as Harland Clarke, are approved by associations like the Check Payments Systems Association (CPSA) and adhere to industry standards for security and quality.

Ordering checks through these verified vendors provides various benefits, including customizable designs, bulk order discounts, and the convenience of home delivery. These vendors usually have dedicated websites where you can select your preferred check style, specify your order quantity, and input your shipping details. Many of these services provide order tracking numbers, enabling you to monitor your shipment from dispatch to delivery.

To ensure a smooth process, always reorder checks well in advance, particularly before your current supply is exhausted. This preemptive approach avoids delays and ensures your checks arrive on time for upcoming transactions. Additionally, refurbishing checks through trusted vendors often offers better security features and a wider range of design options compared to standard bank-issued checks.

Conclusion

Reordering checks is an essential step for anyone relying on physical checks for personal or business transactions. Whether you prefer digital methods, direct communication, in-person visits, or trusted third-party vendors, the options available today make it easier than ever to maintain your check supplies. By understanding each method's benefits and procedures, you can ensure a seamless and hassle-free experience. Always plan ahead, verify your details carefully, and choose the method that best fits your needs to keep your finances flowing smoothly without interruptions.