Effective Strategies to Accelerate Your Mortgage Repayment

Discover comprehensive strategies to accelerate your mortgage payoff, including increasing payment frequency, refinancing options, tax considerations, and downsizing. Learn how to reduce interest costs, eliminate PMI, and set clear goals for a faster path to homeownership freedom. This detailed guide offers practical tips to help homeowners pay off their mortgage more quickly and save thousands over the loan term, empowering you to achieve financial security sooner.

Effective Strategies to Accelerate Your Mortgage Repayment

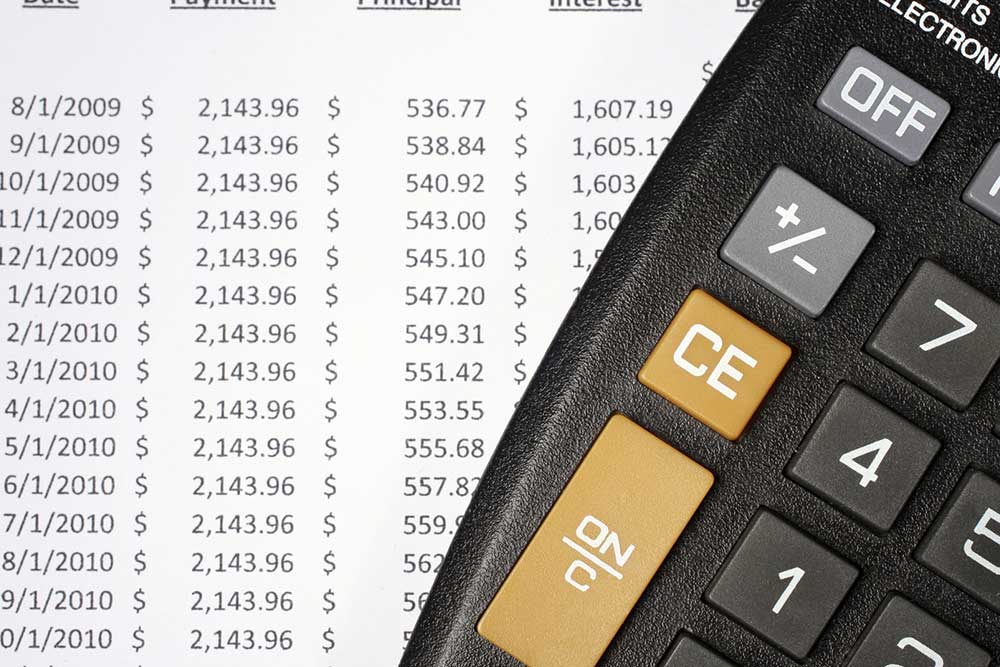

Owning a home is a significant milestone, but for many homeowners, the long-term burden of mortgage payments can feel overwhelming, especially as retirement approaches. The goal of most homeowners is to pay off their mortgage as quickly as possible, minimizing interest costs and achieving financial freedom sooner. While it may seem challenging, there are a multitude of proven strategies that can help reduce the duration of your mortgage and save you thousands of dollars in interest payments over time. This comprehensive guide will explore the most effective methods to speed up mortgage repayment, providing practical tips and insights that you can implement today.

Increase Your Payment Frequency

One simple yet powerful way to reduce your mortgage term is to increase the frequency of your payments. Instead of making monthly payments, consider switching to bi-weekly payments. This approach results in making one extra payment each year, which can shave several years off your loan term and significantly reduce your interest expenses. Even small additional payments made periodically, such as quarterly or semi-annual contributions, can make a considerable difference over the lifespan of your loan. By aligning your payment schedule with your income flow, you can accelerate your mortgage payoff timeline effectively.

Eliminate Private Mortgage Insurance (PMI)

If your initial down payment was less than 20%, you're likely paying for Private Mortgage Insurance (PMI), which adds to your monthly expenses. Once you've built up at least 20% equity in your home through payments or appreciation, you can typically request the cancellation of PMI. Doing so reduces your monthly mortgage payment, freeing up funds that can be redirected toward paying off your mortgage faster. Monitoring your equity level and initiating PMI removal as soon as you qualify can lead to substantial savings and quicker debt repayment.

Refinance to Secure Lower Interest Rates

Interest rates fluctuate based on market conditions. If rates drop significantly below your current mortgage rate, refinancing can be an excellent strategy to save on interest costs. Lower rates translate into reduced monthly payments or the same payments with a larger portion going toward principal, which accelerates your journey to full ownership. Before refinancing, analyze closing costs and ensure that the long-term savings outweigh the upfront expenses. Refinancing is particularly advantageous if you plan to stay in your home long enough to recoup the costs.

Reevaluate Property Taxes Regularly

Property taxes are an ongoing expense that can impact your overall homeownership costs. These taxes are often reassessed periodically, and if local tax rates decrease, your payments may be reduced accordingly. Regularly reviewing your property tax assessments and appealing them when justified can lower your annual expenses, allowing you to allocate more funds toward mortgage repayment. Staying informed about tax rate adjustments and participating in reassessment processes can provide important financial benefits.

Leverage Tax Relief Programs

Many regions and states offer tax relief programs geared toward homeowners. These might include property tax exemptions, credits, or reductions for qualifying homeowners, seniors, or those with specific financial hardships. Contact your local tax authority or a financial advisor to explore available options and determine whether you qualify for any relief programs. Taking advantage of these programs can decrease your property tax burden, freeing up extra funds for mortgage payments and hastening your path to debt freedom.

Downsize Your Home

When your current living space exceeds your needs, downsizing to a smaller property can be a strategic way to pay off your mortgage faster. A smaller home often leads to a reduced mortgage amount, lower property taxes, and decreased maintenance costs. This approach not only shortens your loan term but also can relieve financial pressure, allowing you to focus on paying off your mortgage sooner. Carefully evaluate your lifestyle needs and financial situation to determine if downsizing is a practical option for you.

Additional Practical Tips for Faster Mortgage Repayment:

Utilize Extra Income Wisely: Direct bonuses, tax refunds, inheritance, or large sales proceeds toward your mortgage principal. Even a lump sum payment once a year can have a significant impact on reducing your loan balance.

Set Clear, Achievable Goals: Define specific targets for your mortgage payoff date. Creating a detailed plan helps you stay motivated and disciplined in making consistent extra payments.

Choose a Shorter Loan Term: If your financial situation allows, opt for a 15-year mortgage instead of a 30-year. Although monthly payments are higher, the total interest paid over the loan period is substantially lower, and the home is paid off in half the time.

Monitor and Adjust Your Budget: Regularly review your expenses and identify areas where you can cut unnecessary costs. Redirect those funds toward extra mortgage payments and accelerate your path to debt freedom.

Stay Informed and Seek Expert Advice: Keep abreast of mortgage trends, interest rate movements, and refinancing opportunities. Consulting with financial advisors or mortgage specialists can reveal personalized strategies suited to your unique circumstances.

Paying off your mortgage early requires proactive planning, disciplined financial habits, and an understanding of available options. By implementing these strategies, you can significantly shorten your mortgage period, reduce total interest paid, and enjoy the financial freedom and security of being mortgage-free sooner. Regularly review your progress, stay motivated, and make adjustments as needed to reach your goals effectively.