The Ultimate Guide to Top Banking Institutions in Ohio for All Your Financial Needs

Explore Ohio’s top banking institutions that offer comprehensive services, from extensive branch networks to innovative savings accounts. Learn how Huntington, Chase, US Bank, and PNC Bank serve diverse financial needs with features designed for accessibility, student banking, shared accounts, and wealth growth. This guide empowers Ohio residents to make informed banking choices tailored to their goals, ensuring they get the best services, rates, and convenience across the state.

Comprehensive Guide to the Best Visa Prepaid Cards for Smarter Financial Management

Discover the top Visa prepaid cards designed for smarter spending. This comprehensive guide covers popular options like KAIKU and AccountNow, highlighting key features, fee structures, and digital capabilities. Whether you prioritize low fees, extensive ATM access, or mobile management, find the right prepaid card to suit your financial habits and goals, ensuring efficient, secure, and convenient money management. Perfect for budgeting, savings, or everyday transactions, these cards are essential tools in modern financial planning.

Comprehensive Guide to the Best Home Insurance Providers in 2024

This comprehensive guide explores the top home insurance providers in 2024, focusing on their key features, customizable options, and how to get personalized quotes. Learn how trusted insurers like State Farm, Allstate, Liberty Mutual, and Farmers offer reliable coverage, competitive rates, and excellent customer service. Discover tips for choosing the right policy to safeguard your home effectively, ensuring peace of mind and financial security for homeowners today.

Comprehensive Guide to Colorado's Leading Banking Institutions

This comprehensive guide covers Colorado's top banking institutions, highlighting their key features, account options, and suitability for different customer needs. From large national banks like Wells Fargo and Chase to community banks such as Bank of Colorado, find detailed insights to help you choose the right financial partner. Learn about high-yield savings, affordable checking accounts, and small business banking solutions, along with tips for responsible banking and staying informed with industry news. Whether you're an individual, student, or business owner, this guide simplifies Colorado banking options.

Empowering Your Parents During Retirement: Effective Ways Children Can Provide Support

Supporting your aging parents during retirement is essential for their well-being and peace of mind. This detailed guide offers effective strategies including estate planning, professional financial advice, and emotional support to help children assist their parents in managing assets, planning finances, and ensuring a smooth, stress-free retirement. Empower your parents to enjoy their golden years with confidence and independence through proactive involvement and compassionate support.

Comprehensive Guide to Securing a Personal Loan from Lending Club in 2024

This comprehensive guide provides detailed insights into securing a personal loan from Lending Club in 2024. It covers the application process, eligibility criteria, approval timeline, and tips for increasing your chances of approval, making it easier for prospective borrowers to understand and navigate peer-to-peer lending options effectively.

Effortlessly Manage Your Water Bills with Seamless Online Payment Solutions

Discover how to simplify your water bill payments through secure online platforms. This detailed guide highlights multiple digital payment options, benefits, and tips to ensure timely bills, save resources, and manage water consumption effectively. Whether you're tech-savvy or new to online payments, learn how to maintain uninterrupted water services easily and conveniently.

Comprehensive Guide to Securing Free Grant Opportunities for Nonprofits and Individuals

This comprehensive guide offers valuable insights into accessing free grant opportunities for nonprofits and individuals. It emphasizes the importance of identifying credible sources, avoiding scams, and effectively preparing applications. Key steps include researching official portals, aligning projects with funder goals, meticulous documentation, and persistent effort. With dedication and strategic planning, applicants can significantly improve their chances of securing vital funding to support various initiatives, ensuring success without the costs often associated with grant applications.

Comprehensive Guide to Qualifying for a Personal Loan: Essential Steps and Tips

This comprehensive guide explains essential steps to qualify for a personal loan, including preparation tips, documentation requirements, and how lenders assess eligibility. Learn how to improve your chances of approval and secure favorable terms for your financial needs, whether consolidating debts or funding personal projects. The article emphasizes understanding credit scores, debt-to-income ratios, and employment history, offering practical advice on application strategies to achieve your financial objectives efficiently and confidently.

Top Nationwide Banking Institutions in Oregon for Reliable Financial Services

Explore the top nationwide banks in Oregon that offer extensive financial products, digital banking convenience, and broad accessibility. From Chase to Wells Fargo, learn which banks can meet your personal and business banking needs effectively, backed by decades of trust and service excellence. Ideal for residents seeking reliable, comprehensive banking solutions in Oregon's diverse economic landscape.

Comprehensive Software Tools for Effective Investment Portfolio Management in 2024

Discover top-rated investment portfolio management software in 2024 that simplifies tracking, analysis, and optimization of your investments. From free tools like Personal Capital and Mint to beginner-friendly platforms like Wise Banyan, learn how these solutions can improve your financial decision-making and portfolio performance effectively.

Ultimate Guide to Pet Insurance: Covering Spaying and Neutering Expenses to Protect Your Furry Friend

This comprehensive guide explores pet insurance coverage for spaying and neutering procedures. Discover how insurance plans can help offset surgical costs, the importance of early sterilization, and tips for choosing the best coverage options. Protect your pet’s health and manage expenses effectively with the right insurance plan, ensuring a healthier, happier life for your furry friend and contributing positively to the community by preventing overpopulation.

Comprehensive Guide to Choosing the Perfect Credit Card for Your Financial Needs

Choosing the right credit card is essential for effective financial management. This comprehensive guide helps you evaluate key factors like fees, rewards, acceptance, and credit limits, ensuring you select a card tailored to your spending habits and financial goals. Learn how to compare options, avoid common pitfalls, and make informed decisions for your financial future.

Top 4 Fast-Approval Personal Loan Options for Immediate Funding When You Need Cash Quickly

Discover four top lenders offering quick personal loans with instant approvals for emergencies and urgent expenses. From digital platforms like Monevo and OptaCredit to payday specialists like USA Cash Advance Express, find out how to access fast funds with minimal hassle and quick decision-making. Learn about eligibility criteria, application processes, and tips to secure instant financial assistance when you need cash urgently. Perfect for those facing urgent financial situations, these options help you get money in hand swiftly and efficiently without long approval delays.

Comprehensive Guide to Currency Market Dynamics and Investment Tactics

Explore this detailed guide on currency market dynamics, covering spot, futures, and forward trading, along with strategies for successful investment. Learn how technology and analysis tools enhance trading decisions, and discover risk management techniques crucial for sustainability in forex trading.

Comprehensive Guide to Auto Loans for New and Used Cars: Find the Best Financing Options

This comprehensive guide explores the top financial institutions providing auto loans for new and used vehicles. It details each lender's offerings, including interest rates, application processes, eligibility requirements, and unique benefits. Whether you're a first-time buyer or refinancing an existing loan, learn how to select the best auto financing option to suit your needs and budget, ensuring a smooth car purchasing experience. Make informed decisions with insights into leading lenders like Bank of America, Capital One, DCU, Chase, and Wells Fargo, and discover helpful tips for securing favorable auto loans.

Essential Retirement Investment Strategies to Secure Your Future

This comprehensive guide explores top secure investment strategies for a comfortable retirement. It highlights the importance of early planning and discusses three reliable options: annuities, mutual funds, and individual stocks. The article emphasizes balancing safety and growth to ensure financial stability, offering valuable insights for retirees and those preparing for retirement. By understanding these investment vehicles and choosing suitable options, you can build a resilient retirement portfolio and enjoy a worry-free future.

Comprehensive Guide to the Top Funding Sources for Business Growth in 2024

Discover the top guaranteed business loan providers in 2024 to effectively fund and expand your enterprise. This comprehensive guide covers flexible loan options, repayment plans, and strategic advice for choosing the most suitable funding source. Empower your business growth with insights into trusted financial institutions like Wells Fargo, Capital One, Huntington Bank, TD Bank, and Celtic Bank, each offering tailored solutions to meet diverse needs. Ensure your business’s financial health and future success by making informed borrowing decisions today.

Comprehensive Guide to Top Auto Loan Options for Car Buyers

This comprehensive guide explores top auto loan options, including platform features, benefits, and tips for choosing the best financing solutions for your vehicle purchase. Learn about traditional lenders, online platforms, and quick cash options to make informed decisions and secure favorable rates.

Comprehensive Guide to the Top 5 Dog Insurance Providers for Pet Owners in 2024

Discover the top five dog insurance providers in 2024, offering comprehensive coverage options, quick claims processing, and tailored plans to suit all pet owners. Protect your furry friend from unexpected health costs with trusted companies like Figo, Embrace, Trupanion, Pets Best, and Healthy Paws. Make an informed choice to ensure your dog’s health and happiness today.

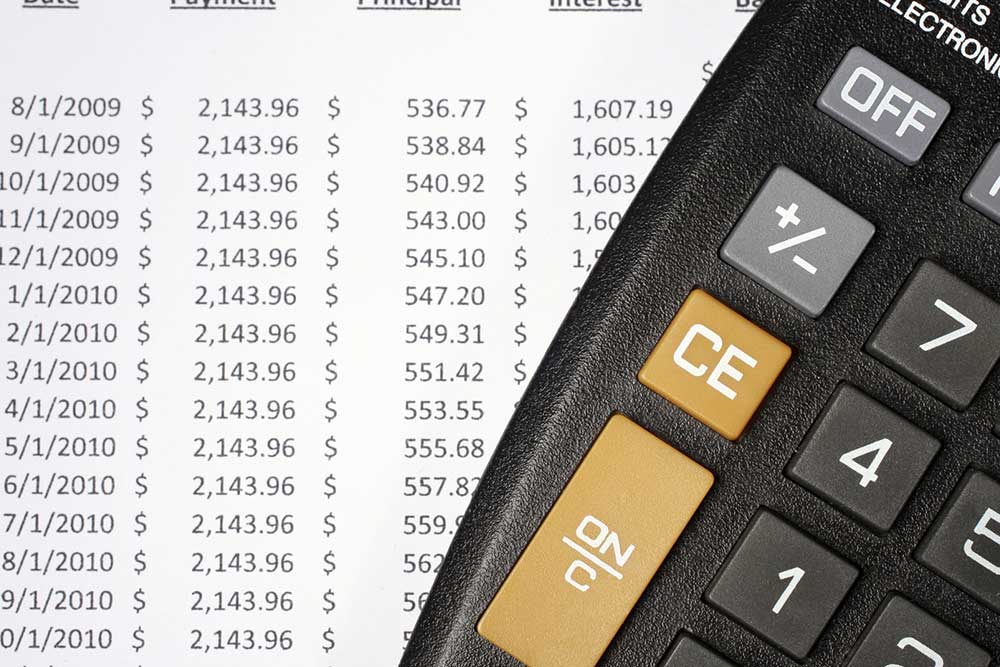

Comprehensive Guide to Amortization Calculators: Types, How to Use Them, and Their Benefits

This comprehensive guide explores the various types of amortization calculators, detailing how to use them effectively and outlining their significant advantages. It covers practical steps for loan calculation, benefits for borrowers, and strategies to accelerate loan repayment, making it an essential resource for smart financial management and informed borrowing decisions.

Top 5 Prime NNN Investment Opportunities in Los Angeles for Steady Income

Discover the top 5 NNN investment opportunities in Los Angeles, featuring properties like convenience stores and service stations. These investments offer stable income, long-term leases, and minimal management responsibilities, making them ideal for passive investors looking to grow their portfolio in a thriving market. Learn about location advantages, lease details, and future growth potential in this comprehensive guide to lucrative NNN properties in LA.

Comprehensive Guide to Immediate Annuities: Secure Your Retirement Income

This comprehensive guide explores immediate annuities, detailing their operation, types, benefits, and how to choose the best plan for secure retirement income. Ideal for retirees planning ahead, the article emphasizes stability and reliability in financial planning.

Your Complete Guide to Successfully Opening an Online Banking Account in 2024

Learn everything you need to know about opening an online banking account in 2024. This comprehensive guide covers essential documents, step-by-step application procedures, and expert tips to ensure a smooth and secure setup. Whether you're new to digital banking or upgrading your current account, discover how to navigate the process efficiently and choose the right bank for your needs.

Comprehensive Guide to Investing in Gold: Strategies for Building Wealth

Discover comprehensive strategies for investing in gold, including physical assets, ETFs, mutual funds, stocks, and derivatives. Learn how to diversify your portfolio effectively with expert insights on optimizing returns while managing risks in the evolving gold market.

Comprehensive Guide to Selecting the Ideal Mutual Fund for Your Investment Goals

Discover how to carefully choose the best mutual funds tailored to your financial goals. This comprehensive guide covers key aspects such as expense ratios, fund management, and performance analysis, helping investors make informed decisions for long-term wealth growth. Learn tips and strategies to evaluate funds effectively and build a diversified investment portfolio aligned with your risk appetite and objectives.

Top Long-Term Investment Opportunities for Wise Investors in Today's Market

Learn about top long-term stocks that promising investors should consider for sustained growth. Discover the key traits of resilient companies, including strong fundamentals, innovation, adaptable leadership, and strategic long-term visions. This comprehensive guide highlights top picks like Boeing, Netflix, Disney, and more, perfect for those aiming to secure their financial future through smart investing strategies over the next 15 years and beyond.