Comprehensive Guide to Monitoring and Enhancing Your Credit Score for Financial Success

This comprehensive guide explores how to access, review, and improve your credit score, emphasizing the importance of regular monitoring and responsible financial behaviors. Learn practical strategies to boost your credit health, prevent fraud, and unlock better financial opportunities. Perfect for individuals seeking to enhance their creditworthiness and achieve long-term financial success.

Comprehensive Guide to Financial Assistance Programs: Who Qualifies and How to Apply

This comprehensive guide explores various government-backed financial assistance programs, detailing eligibility criteria, application strategies, and how individuals and families can access vital support during financial hardships. From housing help to food assistance, understand your options and how to effectively apply for aid to regain stability and security.

Comprehensive Guide to Choosing the Best 401k Retirement Savings Strategy

This comprehensive guide explores various types of 401k retirement plans, including traditional, self-directed, safe harbor, tiered profit-sharing, and Roth options. It provides insights into their features, benefits, and considerations to help employees and employers select the best strategy for secure and efficient retirement savings. Proper plan selection can maximize growth, ensure compliance, and support long-term financial stability.

Comprehensive Guide to Financial Support and Loan Options for People with Disabilities

This comprehensive article explores financial support options for individuals with disabilities, including eligibility criteria, advantages, and various short-term and long-term loan options. It aims to help disabled individuals understand and navigate available resources to manage medical expenses, home modifications, or essential services, ultimately improving their quality of life and financial stability.

Comprehensive Guide to Buying a Motorcycle with Zero Down Payment Options

Discover comprehensive strategies for purchasing a motorcycle with zero down payment, including financing options for all credit levels, advice on improving credit scores, and tips on choosing the best lenders. This detailed guide covers dealer options, credit union benefits, online lenders, and alternative methods like cash payments and co-signers, making motorcycle ownership accessible to more enthusiasts. Learn how to navigate the financial landscape efficiently and ride away with your dream motorcycle today.

Unlocking Financial Flexibility: The Key Benefits of Using Credit Cards Today

Discover the comprehensive benefits of using credit cards in today's digital economy, including rewards, security, and travel perks. Learn how to maximize these advantages responsibly for enhanced financial flexibility and savings.

Top Banks Offering Innovative Digital Savings Accounts in 2024

Discover the top digital savings accounts offered by leading banks in 2024. Learn about secure, high-yield online savings options from Ally, Capital One, American Express, and others. Explore features like no-fee accounts, instant transfers, and FDIC insurance, designed to maximize your savings with ease and safety. Stay ahead in your financial planning by understanding the latest digital banking trends and choices that offer flexibility, security, and competitive interest rates—all from the comfort of your home.

Comprehensive Guide to Key Retirement Investment Funds for a Secure Future

This comprehensive guide explores essential retirement investment funds suitable for long-term growth and financial security. By investing in diversified options like high-dividend yield funds, dividend appreciation funds, and mid-cap ETFs within a Roth IRA, investors can maximize their returns. Early planning and consistent contributions are emphasized to help build substantial wealth for a comfortable retirement. The article offers insights into fund options, tax advantages, and strategies to optimize retirement savings, ensuring readers are well-informed for their financial future.

Comprehensive Guide to Building Consistent and Reliable Passive Income Streams

Learn comprehensive and effective strategies for building reliable passive income streams that can help you achieve financial freedom. Explore real estate investments, dividend stocks, online business opportunities, and more. This guide provides detailed insights into passive income generation, enabling long-term wealth growth and financial stability.

Ultimate Guide to Drafting a Promissory Note Template: Step-by-Step Instructions

This comprehensive guide provides detailed steps for drafting a promissory note, covering essential aspects such as party details, payment schedules, collateral, legal considerations, and signatures. Perfect for individuals and businesses, ensuring legally enforceable and clear loan agreements. Learn how to craft a complete promissory note tailored to your needs with expert advice to avoid future disputes and ensure compliance with legal standards.

Comprehensive Guide to the Top 5 Factors Lenders Evaluate When Approving Loans

Learn about the top 5 key factors lenders evaluate when approving loans, including credit history, debt-to-income ratio, employment stability, liquid assets, and collateral. This detailed guide offers practical tips to improve your chances of loan approval and secure better loan terms, helping you navigate the borrowing process with confidence and preparation.

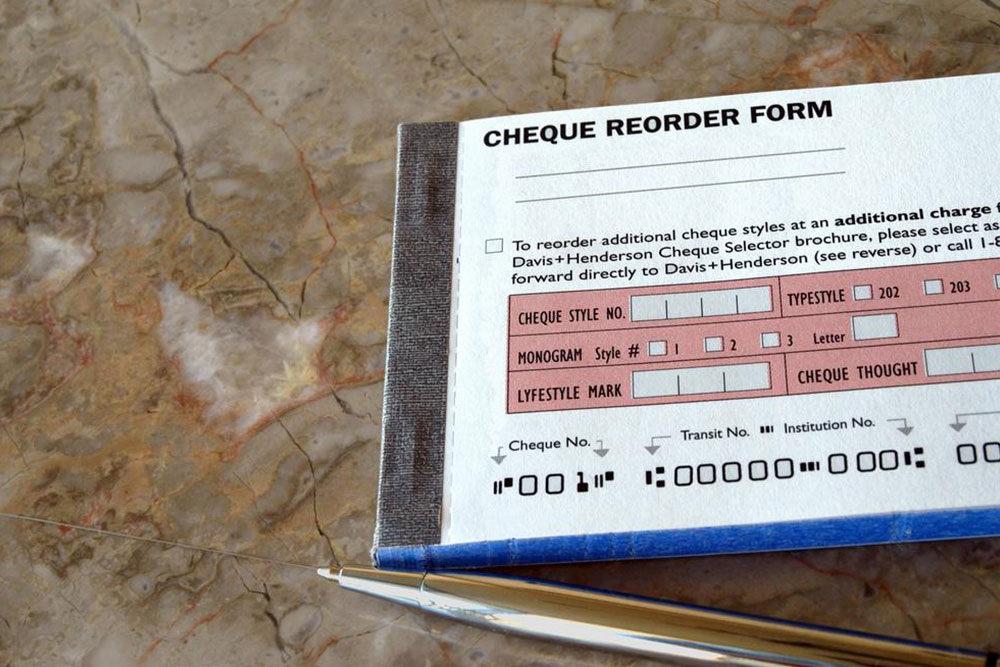

Comprehensive Guide to Reordering Checks: 4 Proven Methods for Smooth Transactions

This comprehensive guide explores four reliable methods for reordering checks, including online platforms, phone banking, in-person visits, and verified third-party vendors. Learn how to quickly and securely order checkbooks to ensure continuous access to this essential banking service, with detailed instructions and tips for each method to help you manage your check supplies efficiently and effortlessly.

Top 4 Affordable Auto Loan Providers for Borrowers with Credit Challenges

Discover the top four auto loan providers ideal for individuals with poor credit. Learn about each lender's unique benefits, flexible qualification criteria, and how they make auto financing accessible for credit-challenged borrowers. Find tips for securing manageable loans and improving your financial situation. Whether you're buying new or used, these lenders can help you navigate auto financing despite a less-than-perfect credit history, enabling you to drive with confidence and financial stability.

Top 3 Credit Cards Designed for Students in 2024: Maximize Benefits and Build Your Credit

Discover the top 3 student-friendly credit cards for 2024 that offer excellent rewards, travel perks, and credit-building features. These cards are designed to fit student budgets, provide valuable benefits, and help establish a strong financial foundation. Whether you're a frequent traveler, a cashback enthusiast, or just starting your credit journey, find the best options tailored to your needs. Learn about key features, rewards programs, and eligibility criteria to make an informed decision this year. Make your financial future brighter with these top-rated student credit cards.

Unlocking the Advantages of Premium Credit Cards: A Comprehensive Guide

This comprehensive guide explores the numerous benefits of premium credit cards, including travel perks, exclusive services, and luxury rewards. Designed for high-net-worth individuals, these cards unlock elite privileges such as airport lounge access, concierge services, and private jet options, enhancing lifestyle and travel experiences. Learn how to qualify, maintain elite status, and maximize your benefits to elevate your financial lifestyle seamlessly. Perfect for high spenders seeking exclusivity and convenience in their daily and travel activities.

Comprehensive Guide to Optimizing Your Home Loan with Effective Calculators and Strategies

Learn how to utilize home loan calculators effectively to plan your mortgage wisely. Discover strategies for making extra payments, choosing the right loan term, and comparing lenders to minimize interest costs and shorten your loan term. This comprehensive guide equips homebuyers with the knowledge to make informed financial decisions and optimize their mortgage plans for long-term savings and financial stability.

Comprehensive Guide to E-Filing 1099 Tax Forms for Seamless Tax Filing Success

This comprehensive guide explores essential steps for efficiently e-filing 1099 tax forms. From choosing proper platforms to ensuring timely submissions, learn how to maximize accuracy and stay compliant with IRS regulations. Discover practical tips on registration, form selection, deadline management, and error prevention to streamline your tax reporting process and avoid penalties. Perfect for businesses, freelancers, and accountants, this guide simplifies the complex task of electronic 1099 filing, saving time and reducing stress throughout the tax season.

Top Money Market Funds in 2023: Your Guide to Safe and Liquid Investments

Discover the top money market funds in 2023 that offer safety, liquidity, and consistent returns. This comprehensive guide explores the best options for conservative investors looking to preserve capital while earning steady income. Learn about key features, minimum investments, and the benefits of each fund to make informed decisions for your financial security.

Comprehensive Guide to Recognizing Risks Associated with Dividend Stock Investments

This comprehensive guide explores the potential risks associated with investing in dividend stocks. It covers tax implications, company performance fluctuations, inflation impact, and the lack of legal obligation for companies to pay dividends, emphasizing strategies for risk management and portfolio diversification. Understanding these factors helps investors make informed decisions and build resilient investment portfolios for long-term income and growth.

Comprehensive Guide to Ensuring a Stable Retirement Income

This comprehensive guide provides proven strategies for securing a stable and stress-free retirement income. From eliminating debt and simplifying finances to investing in annuities and optimizing your investment portfolio, these tips help retirees maximize their savings and ensure financial security during their golden years. Planning ahead with careful management and disciplined investment approaches is key to enjoying a peaceful, comfortable retirement.

How the IRS Influences Ordinary Americans' Financial Stability and Recovery

This article explores how the IRS supports ordinary Americans during financial crises, including bankruptcy relief, tax adjustments, and hardship programs. It highlights the IRS's role in maintaining economic stability and guiding individuals through difficult times with tailored financial aid and relief options. Understanding these processes can help Americans better navigate their financial challenges, ensuring they access necessary support and avoid severe consequences during tough times.

The Essential Role of a Tax Identification Number in Personal and National Development

A Tax Identification Number (TIN) is essential for personal financial management and societal development. It verifies legal identity, facilitates access to government services, and ensures proper tax contribution. This comprehensive article explores the significance of TINs, their role in national infrastructure, and how individuals can acquire and benefit from them. Understanding this vital ID helps citizens comply with laws, protect against identity theft, and participate actively in economic life, strengthening society and supporting public services.

Comprehensive Guide to Choosing a 12-Month Certificate of Deposit: What Investors Need to Know

This comprehensive guide explores the essential aspects of a 12-month Certificate of Deposit, helping investors understand key terms, types, strategies, and current top rates. It offers valuable insights for those seeking safe, predictable investment options, including tips on managing multiple CDs and choosing the right product to match financial goals. Whether you're a beginner or experienced saver, this article provides the knowledge you need to make informed decisions about 12-month CDs, maximizing your returns while understanding potential risks and benefits.

Effective Techniques to Reduce Bank Fees and Maximize Savings

Learn over fifteen practical and effective strategies to minimize bank fees and expenses. From maintaining minimum balances to utilizing digital banking, this comprehensive guide helps you save money while enjoying full banking services. Implement these tips to enhance your financial health and reduce unnecessary costs effortlessly.

Comprehensive Guide to Choosing the Best Online Stock Brokerage for Investors

Choosing the right online stock brokerage is essential for maximizing your investment potential. This detailed guide covers key factors such as account minimums, fee structures, investment options, and trading tools, helping you find a platform that aligns with your financial goals. Whether you're a beginner or an active trader, understanding these elements ensures smarter investing decisions, cost savings, and better access to the markets.

Comprehensive Guide to Boost Your Credit Score for Better Home Loan Opportunities

This comprehensive guide provides detailed strategies to help you enhance your credit score, crucial for securing favorable home loan terms. From timely payments to managing debts and maintaining professional interactions, learn how to build and sustain an excellent credit profile that increases your chances of approval and lowers borrowing costs.

Comprehensive Guide to Choosing the Best Cashback Credit Card for Your Financial Goals

Discover comprehensive strategies for selecting the best cashback credit card tailored to your spending habits and financial goals. Learn key factors, including credit requirements, reward rates, fees, and benefits, to maximize your rewards and optimize your financial health. This guide offers practical tips for comparing options, leveraging sign-up bonuses, and maintaining disciplined spending to ensure a rewarding credit card experience.