Comprehensive Guide to Secure Bank Card Activation and Protection

This comprehensive guide offers essential strategies for securely activating your bank card and safeguarding your financial information. Learn how to ensure safe delivery, use trusted activation channels, protect your personal data, secure your devices, monitor your account, and stay vigilant against scams. Implementing these best practices helps prevent fraud, theft, and unauthorized access, ensuring your banking experience remains safe and hassle-free. Stay informed and proactive to maintain your financial security in an increasingly digital world.

Comprehensive Guide to Secure Bank Card Activation and Protection

Activating your bank card is a crucial step toward gaining full access to your financial resources and utilizing banking services seamlessly. In an era where cyber threats, phishing attacks, and identity theft are increasingly prevalent, it's essential to undertake your card activation process with heightened security awareness. Proper procedures not only ensure your financial security but also help you avoid potential fraud or unauthorized access. This detailed guide provides an extensive overview of vital strategies to securely activate your bank card, safeguarding your personal information and financial assets from malicious hackers and scammers.

1. Ensuring Safe Delivery of Your Bank Card

The initial step in your bank card activation journey begins with the secure receipt of your card. It is important to monitor the delivery process carefully. Always opt for trusted postal service providers and request secure or traceable shipping options if available. When your card arrives, conduct a thorough inspection. Look for any signs of tampering, damage, or suspicious alteration. If the packaging appears compromised or if your card was delivered to the wrong address, contact your bank immediately to report the issue and request a replacement. This step is fundamental in preventing fraud, as stolen or tampered cards can pose significant risks if used improperly.

2. Use Authorized and Verified Channels for Activation

To ensure your bank card's activation process remains secure, always utilize official and trusted channels provided by your bank. Common secure methods include:

Contacting the bank’s dedicated automated phone service using the official customer service number

Logging into the bank’s official online portal through a secure, encrypted connection

Using the bank’s mobile banking application, downloaded exclusively from reputable app stores like Google Play or Apple App Store

Visiting your local bank branch to activate the card in person with a bank representative

Avoid third-party websites or unverified links that may lead to phishing scams. Confirm all contact details directly through official bank communication channels and be wary of unsolicited messages or calls requesting your personal information.

3. Protect Your Sensitive Personal Data

Safeguarding your personal and financial data is imperative during activation and beyond. Follow these security practices:

Never disclose your PIN, passwords, or account details to anyone, including bank staff—your bank will never request this information via email or phone

Create unique, complex passwords for online banking accounts, combining letters, numbers, and special characters

Verify the authenticity of any suspicious calls or emails claiming to be from your bank. Always contact your bank directly to confirm

These measures greatly reduce the risk of data breaches or identity theft.

4. Secure the Devices You Use for Activation

Your smartphones, tablets, and computers are gateways to your financial data. Protect them by implementing strong security practices:

Regularly update the operating system, antivirus software, and applications to patch security vulnerabilities

Install reputable anti-virus and anti-malware programs and keep them updated

Avoid performing sensitive transactions over public or unsecured Wi-Fi networks; instead, use a secured home or mobile data connection

Strong device security reduces the likelihood of malware or hacking attempts during the activation process.

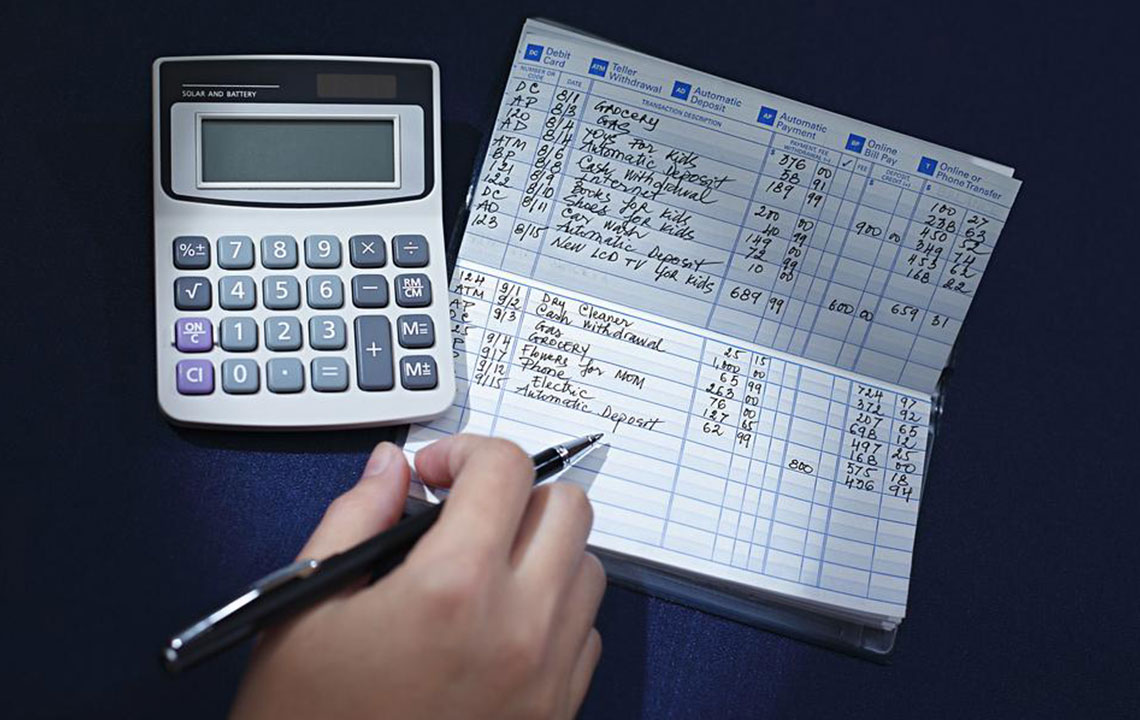

5. Monitor Your Bank Account Post-Activation

Once your card is activated, continue to safeguard your account by actively monitoring transactions:

Set up real-time alerts for transactions over a certain amount

Regularly review your account statements for any unauthorized or suspicious activity

Immediately report any discrepancies or fraudulent charges to your bank

This vigilant approach helps detect and prevent fraud early.

6. Immediate Action for Lost or Stolen Cards

If your bank card goes missing or is stolen, do not delay. Contact your bank immediately to block or deactivate the card. This step is vital to prevent unauthorized usage or potential fraud. Many banks offer 24/7 helplines for such emergencies, ensuring swift action. Once the card is blocked, request a replacement card, and ensure that your account details are secure.

7. Protect Your PIN and Other Authentication Methods

Your personal identification number (PIN) acts as a key to your financial assets. To maintain its confidentiality:

Memorize your PIN and avoid writing it down in accessible places

Change your PIN regularly, especially if you suspect it has been compromised

Cover your hand when entering your PIN at ATMs or point-of-sale terminals to prevent shoulder surfing

These simple precautions can significantly reduce the chances of PIN theft or misuse.

8. Stay Vigilant Against Phishing and Scams

Cybercriminals often exploit fear and urgency to trick users into revealing personal information. Be cautious of:

Phishing emails or messages requesting your banking details or login credentials

Fake websites mimicking your bank’s official portal

Unsolicited calls asking for verification details

Always verify suspicious communications by directly contacting your bank through verified channels before providing any information.

9. Keep Up-to-Date with Security Best Practices

Cybersecurity is an evolving field. Regularly educate yourself about the latest threats and safety tips by:

Following updates from your bank’s official website and cybersecurity blogs

Participating in bank-led security awareness programs

Being cautious about sharing sensitive information online or over the phone

Staying informed helps you recognize and respond to threats effectively, maintaining your financial security at all times.

In conclusion, securing your bank card during activation and throughout its usage is fundamental to safeguarding your financial health. Employing best practices—such as secure delivery, verified activation channels, device protection, vigilant monitoring, and scam awareness—can greatly reduce risks. Remember, staying proactive and cautious is your best defense against cyber threats. By implementing these comprehensive security measures, you can enjoy the convenience of banking online with confidence that your assets and personal data are protected.