Comprehensive Guide to Investing in Penny Stocks for Beginners

This comprehensive guide explores the essentials of investing in penny stocks for beginners, emphasizing risk management, market analysis, and strategic approaches. It highlights promising companies across various sectors and provides actionable tips for new investors looking to navigate volatile markets safely and profitably. A detailed overview ensures readers understand both opportunities and pitfalls of penny stock investments, empowering them to make informed decisions in pursuit of high returns.

Comprehensive Guide to Investing in Penny Stocks for Beginners

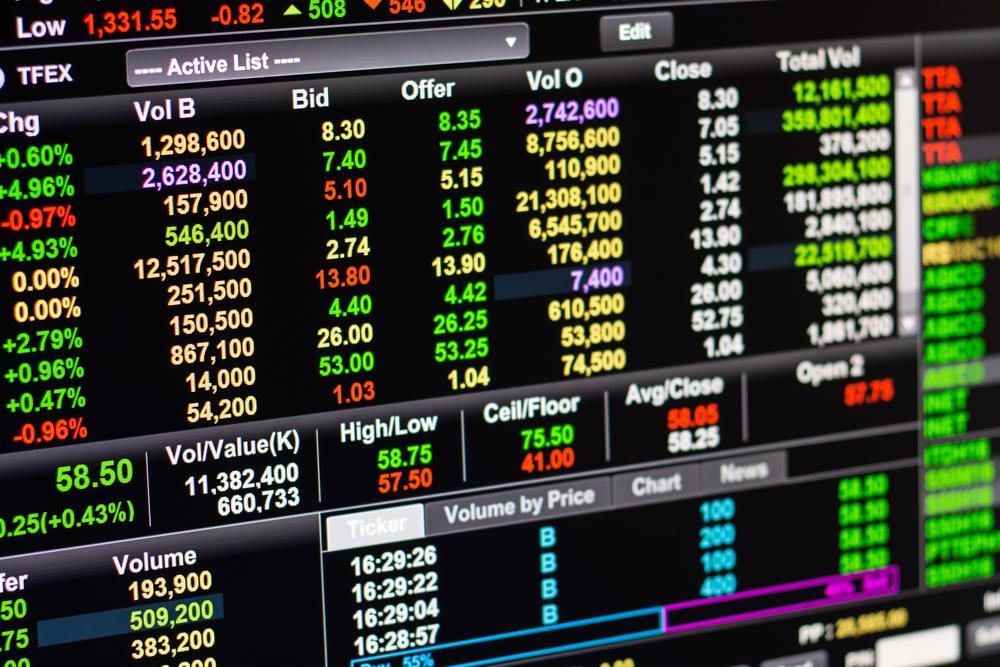

In the world of investing, penny stocks represent a unique opportunity for investors seeking low-cost entry points into the stock market. Often referred to as cent stocks, these securities are typically priced under five dollars per share and can provide significant potential for growth. However, they come with a high level of risk due to their inherent volatility and susceptibility to market manipulation. For new investors, understanding the nuances of penny stocks is vital to making informed decisions and managing potential losses effectively.

Penny stocks are attractive because they require relatively small capital investments, allowing traders and investors to diversify their portfolios even with limited funds. Many investors are drawn to their affordability, hoping to catch quick gains in fast-moving markets. Nonetheless, it is crucial to recognize that these stocks are often associated with small or emerging companies, which may not have established financial stability or transparent operations. As a result, investing in penny stocks demands thorough research, a clear understanding of market risks, and a disciplined trading approach.

One of the main challenges with penny stocks is their propensity for extreme price swings. These price movements can be driven by various factors, including speculative trading, hype, or manipulation schemes. Therefore, novice investors should proceed cautiously, using strategies such as starting with small investments across multiple stocks to mitigate risks. Keeping a diversified portfolio helps prevent significant losses from any single underperforming stock. Additionally, regular monitoring of your investments and staying updated on market news can improve decision-making and responsiveness to sudden changes.

Crucial to successful penny stock trading is thoroughly understanding your own risk appetite and investment goals. Are you looking for short-term gains or long-term growth? Do you have the financial resilience to withstand potential losses? Clarifying such questions beforehand can prevent impulsive decisions driven by market volatility. Before venturing into penny stocks, it is also essential to analyze industry trends and the fundamentals of the companies involved. Sectors such as pharmaceuticals, mining, technology, and consumer goods often host promising penny stocks with growth potential. Conducting fundamental analysis and staying abreast of industry developments can offer a competitive edge.

Some penny stocks currently catching investor attention include a diverse array of companies across different sectors:

John Bean Technologies Corp: Specializing in food packaging machinery and air transport innovations, this company operates in thriving industries, making its penny stocks a potentially lucrative investment. Its focus on automation and technological advancements supports their long-term growth prospects.

Hecla Mining Company: As one of the oldest and largest U.S. silver producers, Hecla demonstrates resilience in the precious metals sector. Its stability amidst volatile markets makes its penny stocks an attractive option for investors looking for exposure to commodities with industry support and favorable policies.

Valeant Pharmaceuticals Intl Inc: This biotech and pharmaceutical firm has experienced fluctuations, but its low stock price and potential for a rebound make it a speculative but promising investment opportunity. Investors should watch for upcoming product launches or approvals that could boost share value.

Twitter Inc: Recently, Twitter has undertaken growth strategies like attracting more users and expanding monetization efforts. Its penny stock status presents a high-risk -- high-reward opportunity for traders willing to gauge social media and technology sector trends.

In conclusion, investing in penny stocks offers the chance for significant gains but requires careful consideration, diligent research, and a disciplined approach. Beginners should start small, diversify their investments, and vigilantly monitor market movements. While penny stocks can be an exciting addition to your investment portfolio, they should be approached with caution and a well-informed strategy to maximize potential rewards and minimize risks.